As it happened: ASX closes higher, households are more indebted, so do we need tougher lending rules?

Australian households' debt-to-income ratio has reached 185 per cent of disposable income. Is it time to impose tougher lending restrictions?

Read about this and how the Australian share market closed higher on Tuesday after an optimistic streak on Wall Street that pushed US stocks to a fresh record high.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4.30pm AEDT

By Nassim Khadem

Thanks for joining us, wherever you are working

By Nassim Khadem

That's all from us today.

Thanks for joining us, wherever you are working.

Perhaps you're still able to work-from-home?

Or perhaps you've been forced to trek back into the office. More of us will be!

Read more about how employers are gaining the 'bargaining power' to make that decision in my story here:

ASX closes higher

By Nassim Khadem

The Australian share market climbed for third session on Tuesday.

The benchmark S&P/ASX 200 index rose 0.5 per cent, or 38.3 points, to close at 7514.9.

The Australian dollar is trading at 66 US cents.

Overnight on Wall Street, stocks inched higher with the S&P 500 closing 0.2 per cent higher.

China mulls stock market rescue package

By Nassim Khadem

China is considering tapping hundreds of billions of dollars in offshore funds as part of a rescue package to stabilise its slumping stock market, Bloomberg reports.

It says says policymakers are seeking to mobilise about 2 trillion yuan ($424 billion), mainly from the offshore accounts of Chinese state-owned enterprises.

This, its reports, is part of a stabilisation fund to buy shares onshore through the Hong Kong exchange link.

Chinese authorities have also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp or Central Huijin Investment Ltd, the report says.

Some of the measures may be announced as soon as this week. But investors are asking, will it be enough to provide a meaningful boost after the rout that Chinese stock market has suffered from since 2021 when stocks peaked?

Why is the share price of a blank check company surging thanks to Donald Trump?

By Nassim Khadem

First let me answer what a blank check company is.

According to the US Securities and Exchange Commission (SEC), "a blank check company is a development stage company that has no specific business plan or purpose or has indicated its business plan is to engage in a merger or acquisition with an unidentified company or companies, other entity, or person".

"These companies typically involve speculative investments," it notes, and "may be subject to additional requirements for the protection of investors".

A type of blank check company is a "special purpose acquisition company", or SPAC for short.

It, the SEC says, is created specifically to pool funds in order to finance a merger or acquisition opportunity within a set time frame.

The share price of blank check company Digital World Acquisition, which said last month it expects to complete its merger with Trump Media & Technology Group, parent of former US President Donald Trump's social media platform Truth Social, has now more than doubled over the past five trading sessions.

The merger has faced multiple delays since it was announced in October 2021.

But on Monday (US time) the stock saw an 88 per cent rally after Trump's rival for the presidential nomination, Florida Governor Ron DeSantis, dropped out of the race and brought Trump even closer to securing a win.

Digital World Acquisition has a stock market value of $US1.5 billion.

Trump had vowed to stick exclusively with Truth Social after he was banned by Twitter following the January 6, 2021, attack on the US Capitol by his supporters.

But he returned to X.com, formerly Twitter, in August, months after his ban was reversed by new owner Elon Musk.

-with wires

Market snapshot

By Nassim Khadem

Figures updated as of 1:25am AEDT

Do we need tougher restrictions on lending to households?

By Nassim Khadem

The IMF recently recommended that Australia adopt tougher macroprudential measures to limit financial stability risks, including restrictions on household debt to income ratios and loan to value ratios.

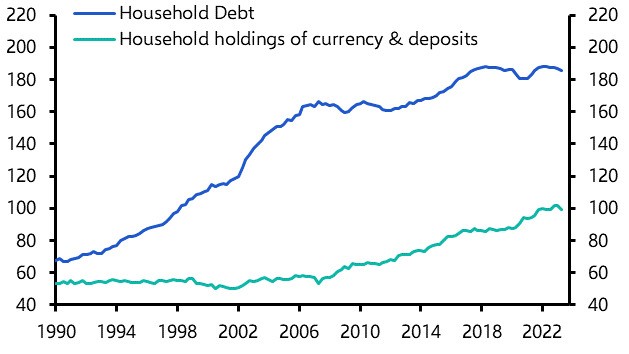

Capital Economics' head of Asia Pacific, Marcel Thieliant, says "at first glance, that makes sense", as "Australian households are as indebted as ever as their debt-to-income ratio was an eye-watering 185 per cent of disposable income in Q3, the latest quarter for which data are available".

"That’s down only marginally from the record high of 188 per cent reached in mid-2022."

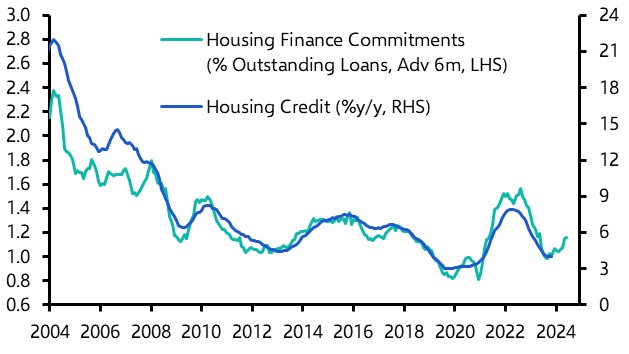

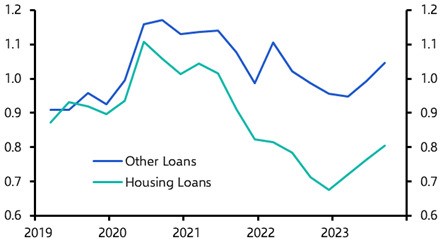

He notes that while banks' reliance on mortgage lending has diminished slightly over the past few years, housing loans still dominate credit portfolios as they account for 60 per cent of outstanding loans.

"What’s more, the ratio of mortgage repayments to disposable income has hit record highs and will keep rising as cheap fixed-rate loans expire," he adds.

"And the recent rebound in housing finance commitments suggests that housing credit growth will soon accelerate from 4.0 per cent y/y in November to around 6 per cent.

He says that would be well above the average 4.6 per cent annual rise in household disposable income since the start of the pandemic and "could result in household indebtedness reaching unprecedented levels".

Even so, he says there's not a compelling case for tighter rules.

While Australian households are more indebted and mortgage payments have hit fresh record highs, he says lending standards continue to be sound, loan defaults remain subdued and banks are well capitalised.

Therefore, he argues "there’s no compelling case to tighten macroprudential regulations".

Under rules imposed by banking regulator APRA, banks are required to apply buffers that assess a borrower's ability to service a home loan at rates 3 per cent higher than those currently on offer.

This rule remains in place for new borrowers, and APRA chairman Jon Lonsdale in October said the 3 per cent buffer rate "is appropriate in the current environment".

Mr Thieliant says Australia's high level of household debt "looks less frightening once we account for the rise in households’ holdings of currency and deposits, which are now equivalent to around 100 per cent of disposable income".

"What’s more, housing lending standards remain sound," he says.

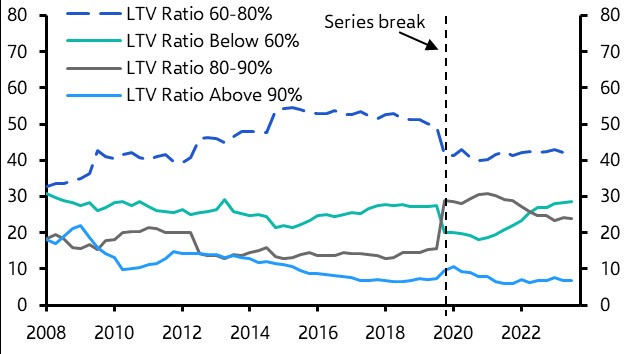

"Riskier interest-only loans have plunged from nearly 40 per cent of the outstanding stock of mortgages in 2015 to just over 10 per cent now.

"Given that their share in new lending has also settled at much lower levels than a few years ago, that share is unlikely to rise again."

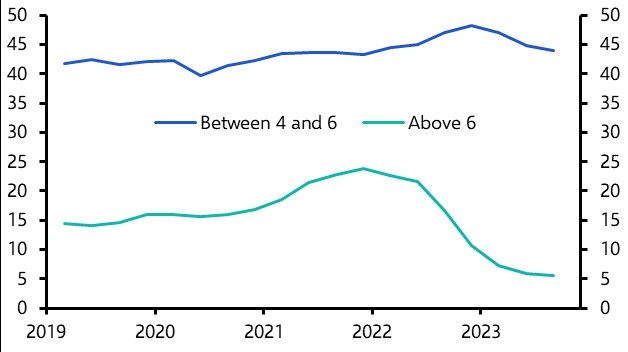

He says rising interest rates have also forced homebuyers to opt for smaller mortgages and the share of new mortgages with debt-to-income ratios above has plunged from one quarter in late-2021 to just 5 per cent currently.

"And with average loan sizes edging down since late-2021 even as house prices have hit fresh record highs, average loan-to-value ratios have declined a bit, too," he adds.

"Housing loans with loan-to-value (LTV) ratios above 90 per cent have become increasingly rare, while those with LTV ratios below 60 per cent have been gaining popularity over the last couple of years."

What about higher unemployment? He says there's a risk that a further rise in unemployment will result in a marked pick-up in non-performing housing loans, which remain very low.

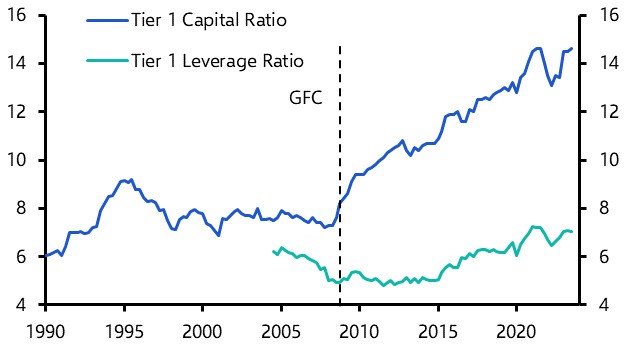

"However, banks remain very well capitalised with their Tier 1 capital ratio at a record high of 14.6 per cent and the ratio of capital to overall assets having risen since the GFC, too," he notes.

"Banks’ return on assets was a healthy 0.6 per cent over the past year which gives them plenty of scope to absorb higher loan losses."

"More importantly, tighter macroprudential regulations could restrain the volume of new lending, which could exacerbate the current weakness in the economy and lift unemployment rate by even more than otherwise.

"That in turn could result in higher loan losses than in the absence of tighter macroprudential measures and would be counterproductive."

Read more about the current lending restrictions and how some Australians, desperate to break into the property market, are resorting to lying on their home loan applications here:

Mining revenue rises again off the back of higher prices for iron ore, coal

By Nassim Khadem

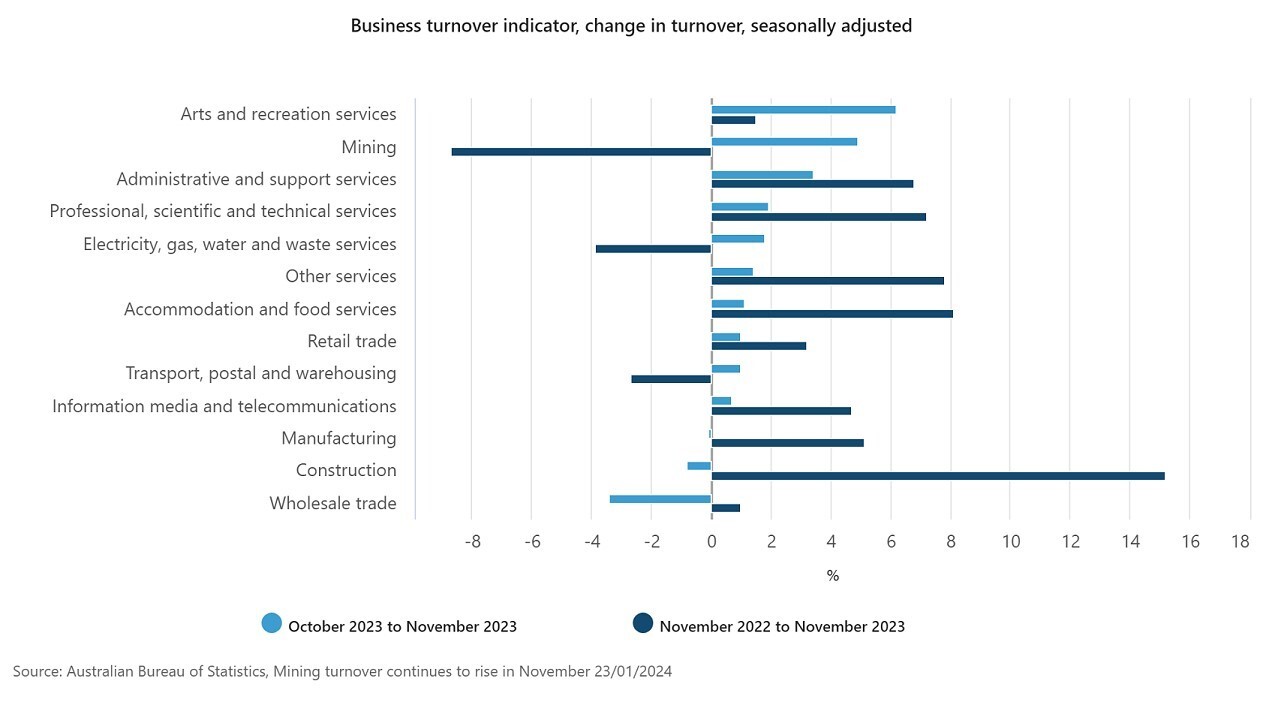

Higher iron ore prices and renewed demand for coal saw business turnover for the mining industry rise for the fourth consecutive month in November (+4.9 per cent), according to figures released today by the Australian Bureau of Statistics (ABS).

ABS head of business statistics Robert Ewing said 10 of 13 industries had rises in business turnover in November.

The industries that saw the biggest annual rises were construction (+15.2 per cent), accommodation and food services (+8.1 per cent), and other services (+7.8 per cent).

Others included arts and recreation services (+6.2 per cent), and retail trade and transport, postal and warehousing (both +1.0 per cent).

Mr Ewing said retailers and parcel delivery businesses benefitted from the Black Friday sales period.

Annually, the biggest falls were in mining (-8.7 per cent), and electricity, gas, water and waste services (-3.9 per cent).

Businesses facing weaker conditions and 'cautious' mindset: NAB survey

By David Chau

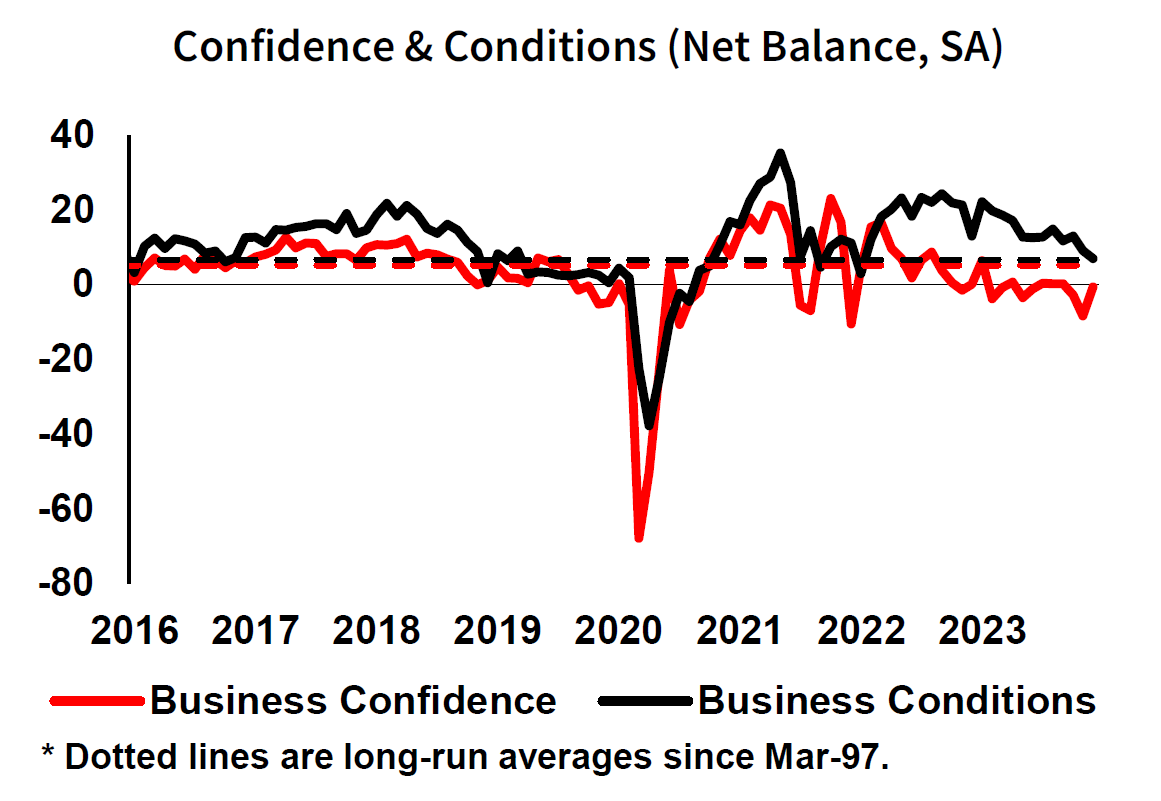

It's not just consumers who are feeling downbeat about the economy.

Businesses are also feeling the gloom, according to NAB's closely watched business survey — but nowhere near as much.

The bank surveys 500 businesses each month about their view on business conditions and confidence, and the December result is generally weaker than previous months.

Business conditions eased further last month to +7 index points, according to NAB's index (which is around the long-term average).

In comparison, business conditions were slightly higher at +9 points in November.

This decline was led by the manufacturing and construction sectors (down by 16 and 12 points, respectively), and they remained weak in the retail sector.

Business confidence, however, rebounded (from a very low base) to -1 index points.

This means businesses are still feeling negative, as 0 points is the dividing line between optimists and pessimists.

The biggest rebound in confidence was seen in the mining and retail sectors (up 28 and 24 points, respectively).

The reason for this appears to be retail inflation cooling down (in particular, the slower rise in wages and purchasing inputs).

"Overall, the survey results show that economic growth had eased considerably by the end of 2023 after performing better than expected for much of the year, and this slowing is beginning to translate into improvement in inflation indicators," NAB economists wrote in their business update.

"Nonetheless, businesses remain cautious about the outlook with growth likely to remain subdued for the time being."

Market snapshot

By David Chau

Figures updated at 10:55am AEDT

US bull market driven by AI fever and hopes of Fed interest rate cuts

By David Chau

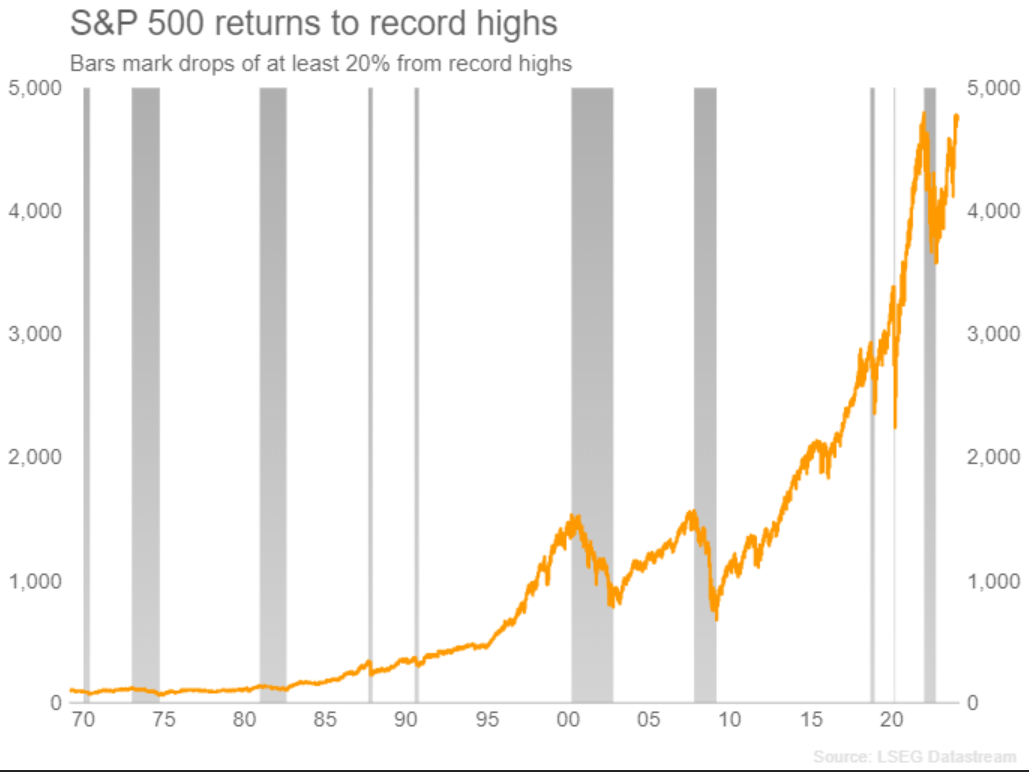

Wall Street is officially in a bull market, with the S&P 500 closing at a record high for the second straight day.

This upbeat sentiment is helping to boost share markets across the world, including Australia.

As it turns out, US markets have been in a bull market since October 22 (when the index bottomed).

Since then, the benchmark S&P index has surged by about 35%.

Reuters has created these fascinating graphs showing the magnitude of the bull market and what's driving this optimism.

Signs of slowing inflation and a dovish pivot from the US Federal Reserve in late 2023 helped boost US stocks, sending the S&P 500 to a 24% annual gain.

In recent days, a rally in chip stocks fuelled by optimism over the business potential of artificial intelligence (AI) has lifted the index further.

As stocks have tended to rise more than fall throughout their history, the S&P 500 has been in a bull market for roughly 85% of the time since 1950.

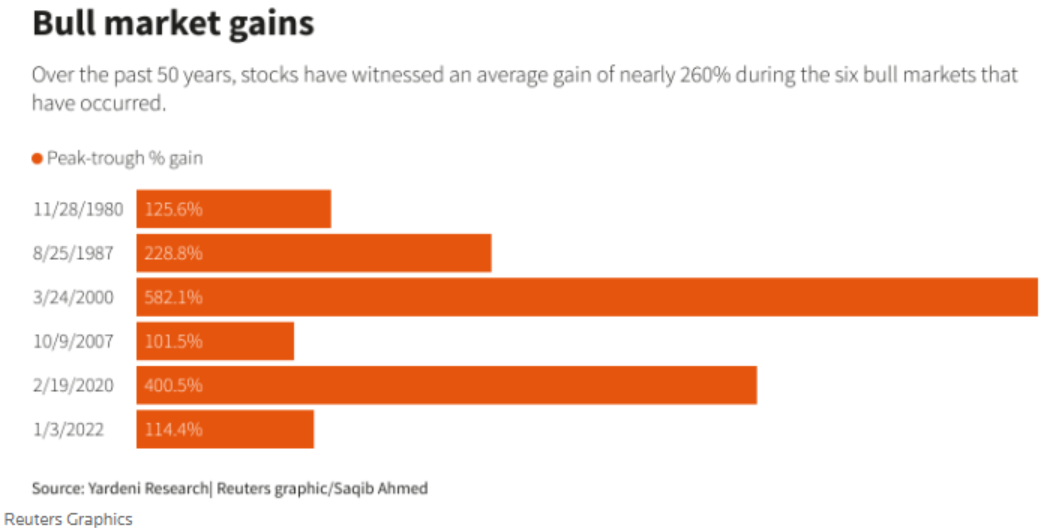

The index has notched an average gain of nearly 260% during the six bull markets that have occurred in the last four decades.

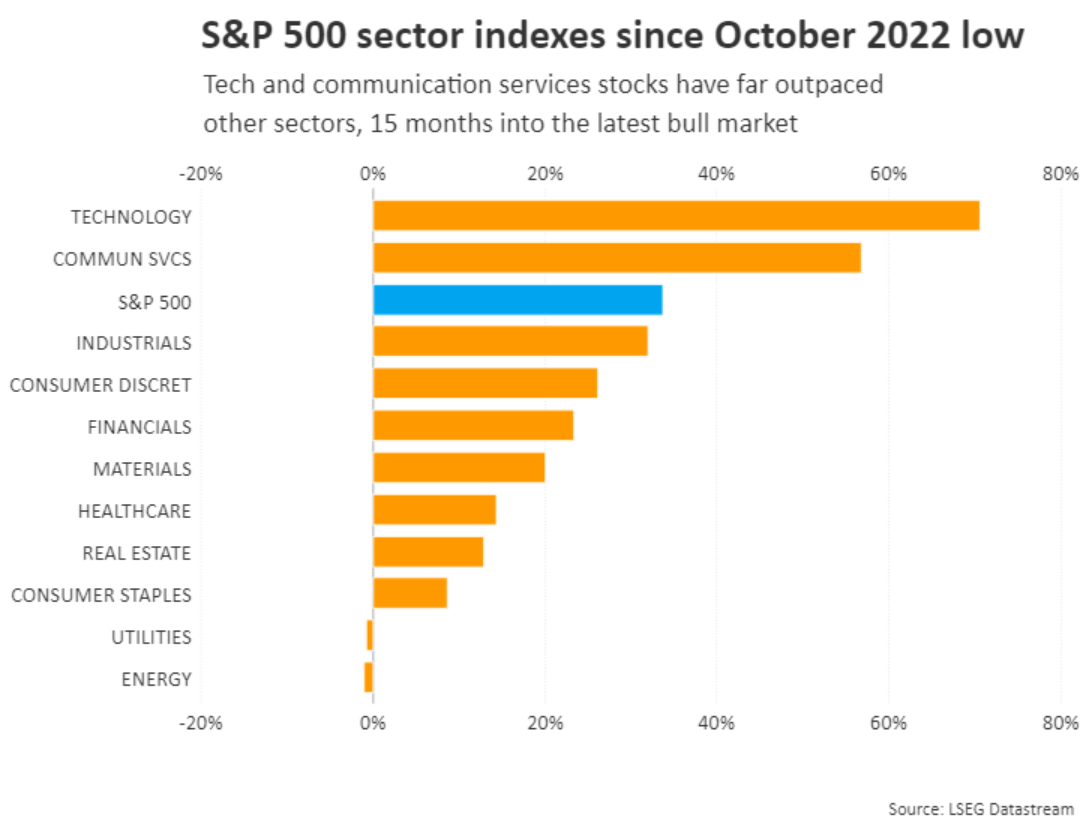

The index's rally since October 2022 has been driven by Wall Street's technology-related giants, including Microsoft, Tesla, and Alphabet (Google's parent company).

Given their heavy weighting in the S&P 500, these stocks accounted for 62% of the index's total return last year, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

Another factor powering stocks has been excitement over AI technology, giving a powerful boost to companies such as Nvidia (which is now the world's most valuable chipmaker after its stock tripled in value last year).

Those gains have continued this year, sending Nvidia's share price to a fresh record high.

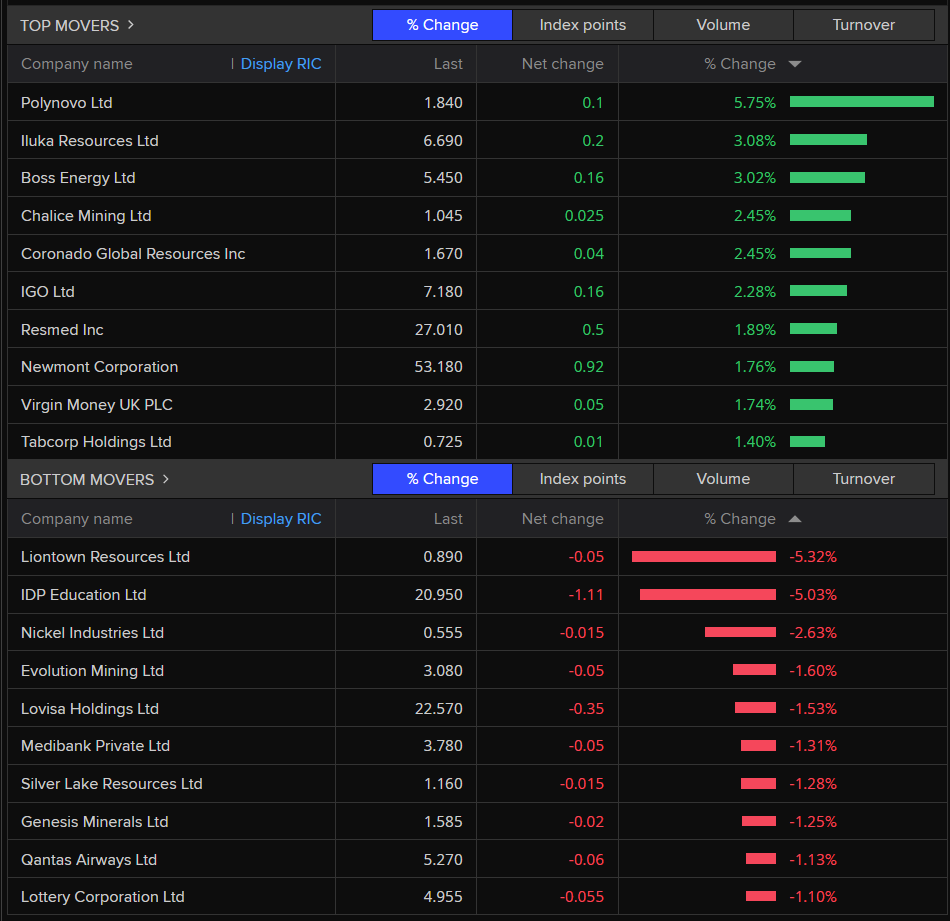

Healthcare and resource stocks drive ASX higher

By David Chau

The Australian share market is off to a better-than-expected start following another session of record highs on Wall Street.

The ASX 200 index was up 0.3% to 7,495 points by 10:20am AEDT, with utilities and healthcare being the best-performing sectors.

Today's best performers include healthcare companies Polynovo (+5.8%) and Resmed (+1.9%), along with resource stocks such as Iluka Resources (+3.1%), Boss Energy (+3%) and Chalice Mining (+2.5%).

Meanwhile, Liontown Resources (-5.3%), IDP Education (-5%), Nickel Industries (-2.6%) and Evolution Mining (-1.6%) have fallen sharply.

Albanese hints at expansion of stage 3 tax cuts to benefit lower-income earners

By David Chau

Prime Minister Anthony Albanese has given the strongest indication yet that the stage 3 tax cuts will be expanded to benefit lower-income earners.

He told KIIS FM on Tuesday morning that "everyone" would get a tax cut. The stage 3 tax cuts as legislated give no tax cut to those who earn less than $45,000.

Government MPs will meet in Canberra on Wednesday to consider additional cost-of-living supports.

For more on this, here's the story by Tom Crowley:

'Cyber sanctions' used for first time to target Medibank hacker

By David Chau

The Australian government has announced sanctions against Russian man Aleksandr Ermakov over his role in the Medibank Private data breach.

It is the first time the government has used its cyber sanctions framework, which was legislated in 2021 to apply financial punishments to people involved in significant cyber attacks.

The personal information of 9.7 million Medibank customers, including names, dates of birth, Medicare numbers and sensitive private health information, was stolen in 2022. Much of it was published on the dark web.

Bitcoin falls to $40,000, lowest level since ETF launch

By David Chau

Bitcoin has fallen to a seven-week low, trading below $US40,000 for the first time since the launch of 11 spot bitcoin exchange-traded funds earlier this month.

The world's largest cryptocurrency quickly recovered, and was last down 3.39% at $US40,181 (its weakest level since December 4).

Ether, the second largest cryptocurrency, was down 5.8% at $US2,343.55.

Bitcoin's fall follows a run-up in the token on growing excitement the US Securities and Exchange Commission (SEC) would approve bitcoin ETFs, opening up the cryptocurrency to a slew of new investors.

Bitcoin gained around 70% from August, when a federal court forced the SEC to review its decision to reject Grayscale Investment's bitcoin ETF application.

Some analysts said they had expected bitcoin to initially pare some of those gains.

Other market-watchers said the cryptocurrency was having a tough time competing with traditional stocks after Wall Street's benchmark index (the S&P 500) hit a fresh record high.

“It feels like bitcoin investors are running up a descending escalator right now as traditional financial benchmarks enjoy the easier ride to record highs,” said Antoni Trenchev, co-founder of crypto lender Nexo.

He noted previous major crypto events, including the initial public offering of crypto exchange Coinbase and the launch of bitcoin futures, were followed by similar bitcoin slumps.

"Spot bitcoin ETFs are in danger of joining the ... crypto hall of infamy," he said.

US corporate regulator's 'X' account hacked with 'SIM swapping'

By David Chau

America's corporate watchdog was the victim of "SIM swapping" (a technique internet fraudsters use to seize control of telephone lines) when its account on the social media platform X (formerly known as Twitter) was hacked earlier this month, the US Securities and Exchange Commission has confirmed.

The SEC also said that, six months prior to the attack, staff had removed an added layer of protection known as multi-factor authentication and did not restore it until after the January 9 attack.

As anticipation mounted for the agency's approval of bitcoin exchange-traded products (ETFs), an unidentified person or persons gained access to the account, tweeting the false announcement that approval had already been granted.

This caused the price of bitcoin to surge to a near two-year high (before it fell sharply, minutes later).

In a split vote, the commission granted approval the following day.

SIM swapping is a technique in which attackers gain control of a telephone number by having it reassigned to a new device.

"Once in control of the phone number, the unauthorized party reset the password for the @SECGov account," an SEC spokesperson said in a statement.

Law enforcement agencies are working to learn how the hackers prevailed on the SEC's mobile carrier to make the switch, the SEC said, without identifying the carrier.

US politicians have demanded explanations about how the SEC could have left itself exposed to such an attack when it holds publicly traded companies to tough cybersecurity requirements.

The incident is under investigation by several US agencies, including the:

- SEC's Office of Inspector General and its Division of Enforcement,

- Commodity Futures Trading Commission (which regulates bitcoin futures),

- Federal Bureau of Investigation (FBI),

- Department of Justice

- Cybersecurity and Infrastructure Security Agency.

H&M pulls ad after complaints over sexualisation of schoolgirls

By David Chau

Fashion retailer H&M has withdrawn an ad featuring schoolgirls after complaints the campaign encouraged the sexualisation of under-age girls.

The ad, launched in Australia, featured the slogan: "Make those heads turn in H&M's Back to School fashion" above a photo of two girls wearing grey H&M pinafore dresses.

"We have removed this ad," an H&M spokesperson said on Monday.

"We are deeply sorry for the offence this has caused and we are looking into how we present campaigns going forward."

A number of social media users took screenshots of the ad before it was removed by H&M.

This is the latest in a string of missteps by fashion brands.

In December, Zara pulled a campaign featuring a model carrying a mannequin — covered in a white sheet — over their shoulder.

This sparked calls for a Zara boycott and protests over a perceived resemblance of the mannequin to images from the war in Gaza (in particular, dead bodies covered in white Muslim burial cloths).

BHP to suspend some operations at WA nickel plant from June

By David Chau

BHP will temporarily shut part of its Kambalda nickel concentrator in Western Australia in June.

It comes after mining magnate Andrew Forret's Wyloo Metals (which supplies ore to the plant), announced a pause in mining due to low nickel prices.

About 20 roles will be affected.

BHP's move is the latest in string of writedowns and restructures of nickel businesses in the country after a sharp jump in Indonesian supply which has led to nickel prices dropping 45% in the past year.

Australia's top nickel producer said it would put the crushing, milling and flotation circuit at its Kambalda plant on care and maintenance but would continue to run part of the plant as a drying circuit to process third-party concentrate.

BHP, which has a deal to supply Australian nickel to Tesla, last week flagged it could take a writedown at the division that accounts for a key plank of its green energy transition strategy but less than 1% of its revenue.

Andrew Forrest's Wyloo Metals to shutter Kambalda nickel mines after prices slump

By David Chau

More than 250 mining jobs are set to be affected by the closure of another operation in Western Australia's once-booming nickel industry.

It comes as a resources analyst warns there could be several tough years ahead for the sector.

Billionaire Andrew Forrest's Wyloo Metals has confirmed its Kambalda nickel mines will be placed in care and maintenance mode by May 31.

Prices for the stainless steel and battery ingredient slumped 45% in the past 12 months.

It comes barely six months after Mr Forrest's private company paid $760 million to acquire the Cassini, Long and Durkin mines at Kambalda, which employ 44 Wyloo workers and 220 contractors.

For more, here's the story by Jarrod Lucas:

Low and middle-income earners to pay thousands more due to bracket creep, according to PBO

By David Chau

The median income earner will pay an extra $5,000 in the next three years due to bracket creep.

But they will get minimal benefit from the stage 3 tax cuts, according to analysis by the independent Parliamentary Budget Office.

The tax cuts, which take effect in July, will apply a 30 per cent tax rate to income earned between $45,000 and $200,000.

Those with taxable incomes below $45,000 will get no benefit, while those above $200,000 will get $9,075.

The government has insisted it remains committed to the tax cuts, and says returning bracket creep is a key reason why.

For more on this, here's the story by Tom Crowley:

ABC/Reuters